Introduction

Investing is the act of buying assets, expecting that they will increase in value or generate income. This can be a good way to potentially grow your income because of how the value of the investments grow over time.

Types of investing

There are three types of investing time terms, which are long-term, medium-term, and short-term investing. A long-term investment is where you invest in something and hold onto it for more than 5 years. A long-term investment is used to create a stable portfolio over a long period of time to generate higher returns. Mid-term investments are investments held for 2-5 years which could involve saving for goals like a house or college. Short-term investments are any investments held for less than 2 years which are used to meet short-term goals like saving for a car or vacation. There are also other people who tend to turn this into self-employment by day trading. Day traders buy and sell securities within a day to profit from short-term price movements.

Why this is beneficial

Investing is beneficial because it can provide more wealth overtime. Investments provide higher returns and generate passive income. Investing takes advantage of the growing economy and is overall a better option than a savings account. Investments also provide a tax advantage since many are tax-deferred, meaning you won’t owe taxes on the growth until retirement.

Risks of investing

Investing comes with risks that you should be aware of. Market fluctuations, economic downturns, and unexpected changes in a company’s performance can affect all the value of your investments. Understanding these risks, diversifying your portfolio, and having a long-term plan can help you manage potential losses.

Growth in investments

The average long-term investment return on the market is 10% annually, but the average rate is reduced by inflation. The average salary for day traders is $96,000 but can be increased if you have good strategies and understand what impacts the market. Top day traders earn hundreds to thousands a day, but can be influenced to be higher or lower by the conditions of the market and the trader’s strategy.

Where you can invest

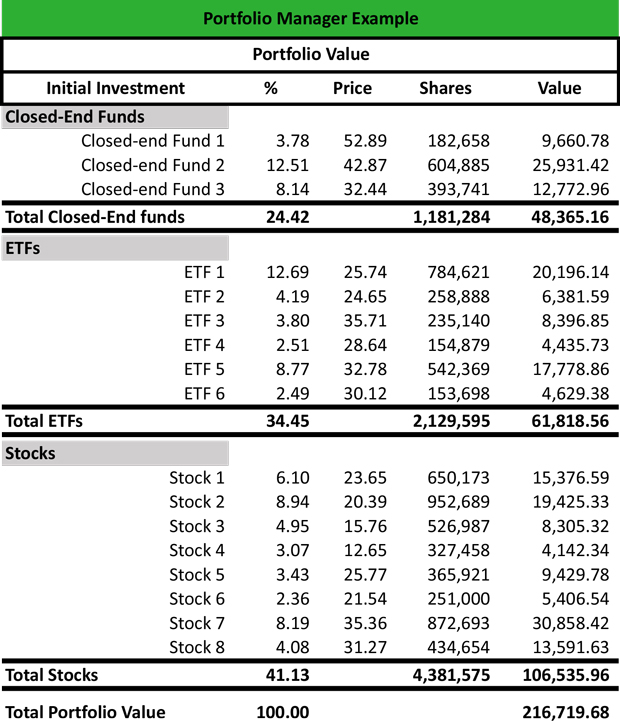

You can invest in a variety of places depending on your financial goals. Popular options include stocks, where you buy shares of companies, and bonds, which offer fixed interest returns. Real estate is another choice, allowing you to invest in properties for rental income or value appreciation. Mutual funds and ETFs, which are a collection of assets, combine multiple investments, offering a diversified approach. Retirement accounts like 401(k)s and IRAs are also good for long-term growth because they allow an employee to contribute a portion of their check to an account. You can also invest in cryptocurrencies, which offer high growth potential but come with significant volatility and risk. These options provide flexibility for different levels of risk and investment strategies.

Best things to invest in (In my opinion)

The best thing to invest in currently are cryptocurrencies. I think cryptocurrencies, like Bitcoin, have the potential to keep growing. Bitcoin has had growth rates way higher than the top stocks today and is currently sitting at $95,000 per unit . The second best thing would be stocks which experience a good amount of return and are less risky than cryptocurrencies.

Conclusion

In conclusion, investing helps your money grow and builds financial security. While there are risks, smart choices and diversification can lead to long-term success and a brighter financial future.